Our People

Our People Make the Difference

“Our people are everything. You can have a great strategy, but if you don’t have the people to execute, you have nothing. You can have a great mission statement, but if you don’t have the people who care about it, it’s not true.”

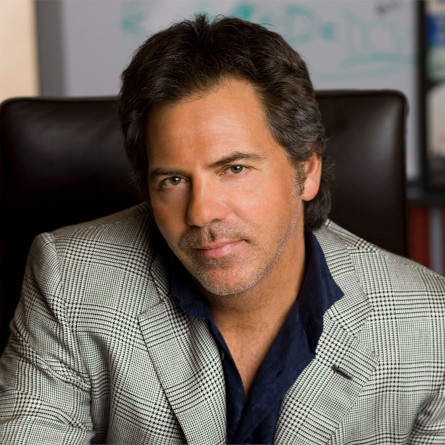

– Tom Gores, Chairman & CEO

Executive Leadership

-

Tom Gores

Chairman & CEO -

Jacob Kotzubei

Co-President -

Louis Samson

Co-President -

Mary Ann Sigler

Chief Financial Officer -

John Holland

General Counsel -

Mark Barnhill

Partner -

Stephanie Barter

Partner -

John Diggins

Partner -

Bryan Kelln

Partner -

Johnny Lopez

Partner -

Phil Norment

Partner -

Robert Wentworth

Partner -

Bob Wymbs

Partner

Filter

Filter

- Name

- Title

- Department

- Location

- Fries, Nick

- Managing Director

- M&A

- Los Angeles

Nick Fries is responsible for the structuring and execution of acquisition and divestiture transactions. He also has responsibilities related to post-acquisition monitoring and oversight of operational performance at certain portfolio companies. Prior to joining Platinum Equity in 2007, Mr. Fries worked at Credit Suisse. Mr. Fries holds a bachelor’s degree in Economics from Occidental College.

- Glatt, David

- Managing Director

- M&A

- Greenwich

David Glatt is responsible for the structuring and execution of acquisition and divestiture transactions. He also has responsibilities related to post-acquisition monitoring and oversight of operational performance at certain portfolio companies. Prior to joining Platinum in 2008, Mr. Glatt worked in the Mergers and Acquisitions Group at CIBC World Markets in New York. Mr. Glatt holds an undergraduate degree from the University of Pennsylvania and a Master’s degree in Business Administration from Columbia Business School.

- Goni, Fernando

- Managing Director

- M&A

- London

Fernando Goni is responsible for negotiating and structuring new acquisition opportunities in Europe. Prior to joining Platinum Equity in 2017, Mr. Goni was a Managing Director and member of the investment committee at The Gores Group. There he was responsible for European acquisitions and divestitures. Mr. Goni also previously worked as an associate at Morgan Stanley and in the Business Consulting unit of Arthur Andersen. Mr. Goni holds a BSc. and a MSc. in Economics from the London School of Economics.

- Gores, Tom

- Chairman & CEO

- M&A

- Los Angeles

Tom Gores founded Platinum Equity in 1995 and his guidance, core philosophies, and strong principles drive the strategic development and direction of both the firm and its portfolio.Early in his career, Mr. Gores was an active investor in smaller businesses, where companies often trade principally on their good word and ability to follow through on what they promise. Here he developed his principles of empowerment, hard work, and integrity. As he delivered on commitments made to deal partners, investment bankers, and lenders, Mr. Gores ability to continually execute larger transactions grew exponentially and made Platinum Equity one of the premiere private equity firms in the world, recognized as one of Forbes "Largest Private Companies" within just 4 years of being founded.

- Hasleton, PJ

- Principal

- Corporate Services

- Los Angeles

PJ Hasleton is Platinum Equity’s Chief Technology Officer, responsible for the corporate technology strategy and operations. Prior to joining Platinum Equity in 2022, Mr. Hasleton worked at Andreessen Horowitz (a16z). Mr. Hasleton holds a Master’s degree in Communication Systems from Northwestern University and a Bachelor’s degree in Economics from Brigham Young University.

- Holland, John

- Managing Director

- Corporate Services

- Los Angeles

John Holland is Platinum Equity’s General Counsel, overseeing the legal department and legal affairs for the firm and its portfolio companies. Prior to joining Platinum Equity in 2020, Mr. Holland was Executive Vice President, Chief Legal and Human Resources Officer at Incora (formerly Wesco Aircraft). Prior to Incora he served as a Partner at Latham & Watkins. Mr. Holland holds a Bachelor of Arts in Humanities and English from Brigham Young University and a J.D. from Columbia Law School.

- Hunt, Benjamin

- Principal

- M&A

- Los Angeles

Benjamin Hunt is responsible for financial due diligence and supports the structuring and execution of acquisition and divestiture transactions. Prior to joining Platinum Equity in 2011, Mr. Hunt held positions at RSM and KPMG. Mr. Hunt holds a BS in Business Administration (Finance and Accounting) from Trinity University and a Master of Accounting from University of Southern California.

- Hutchins, Jared

- Principal

- Operations

- Remote

Jared Hutchins is responsible for managing the transition of newly acquired companies into Platinum Equity’s portfolio. He also has responsibilities related to post-transition monitoring and oversight of operational performance at certain portfolio companies. Prior to joining Platinum Equity in 2016, Mr. Hutchins held positions at TPG, Alvarez and Marsal and Textron. Mr. Hutchins holds a BBA in Supply Chain Management and Marketing from Texas Christian University.

- Itani, Ramzi

- Principal

- Business Development

- London

Ramzi Itani is responsible for business development activities focused on identifying and evaluating new acquisition opportunities in and around Europe and the Middle East. Prior to joining Platinum Equity in 2013, Mr. Itani was a Director of Investment Banking at Citigroup. Prior to Citigroup, Mr. Itani was a Vice President at Merrill Lynch. Mr. Itani holds a bachelor’s degree from Imperial College and a master’s degree in Business Administration from London Business School.

- Kelln, Bryan

- Partner

- Operations

- Remote

Bryan Kelln is a Partner, President of Portfolio Operations and member of Platinum Equity's Investment Committee. He is responsible for all aspects of business strategy and operations at Platinum Equity's portfolio companies, and is involved in evaluating buy and sell-side opportunities across the firm. He works closely with the firm's Operations Team as well as portfolio company executive management to drive strategic initiatives and to deploy operational resources. Mr. Kelln is a seasoned executive with a strong track record of conceiving and executing successful strategic and operational transformation programs across a broad range of different industries. His unique combination of financial, management, M&A and operational expertise are well suited to helping create value within Platinum’s portfolio companies.

Platinum Equity Portfolio

The Platinum Equity portfolio consists of an industry-diverse, multi-billion-dollar group of approximately 50 operational complex businesses.

Our Portfolio